To resolve Utah's Building Code Identity Crisis, Listen to Mom

Better air quality or slower adoption of building codes? Like a rebellious teenager, Utah is having an identity crisis over building codes. The answer, of course, is to listen to mom.

According to Ingrid Griffee, executive director of Utah Moms for Clean Air from a KSL.com post:

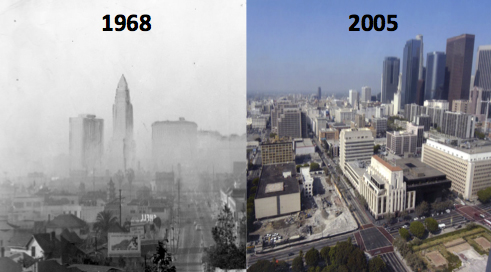

Waiting at least six years to update our codes means Utahns will not have the energy efficient homes we need to help clean up our air and save money.

Polling indicates that Utahns want better air quality, and the Clean Air Action Team created by Governor issued a formal report that included more stringent energy codes to help achieve this goal.

At the same time, HB 285 was introduced in the Utah legislature which would extend the building code adoption cycle to 6 years (down from the recommendation of a 9 year cycle last session). The bill also requires a cost-benefit analysis of each provision of new codes applicable to 1- and 2- family dwellings and low rise townhouses.

These two efforts are fundamentally incompatible. The 2009 codes were 15% more energy efficient than the 2006 codes, the 2012 codes were 15% more energy efficient than the 2009 codes, and the 2015 codes gave more options for builders to comply.

If Utah had skipped the 2009 or 2012 code cycles, energy efficiency and the air quality benefits would have been missed as well. If the 2015 codes were skipped, builders would miss out on cost savings.

The provision-by-provision cost-benefit requirement has been shown in other states, like North Carolina, to be a tactic to delay or derail adoption of new codes.

From an economic standpoint, the changes have already been subject to an economic analysis by the International Code Council committees that evaluate code changes. For the forthcoming cycles, a new ICC policy change now not only requires advocates to indicate whether a proposed code change will increase the cost of construction, along with a requirement to substantiate the cost increase, but also carries a stipulation that if a cost impact statement or substantiation is not provided, the proposed code will be considered incomplete and not processed.

Second, there were 1900 changes from the 2012 to the 2015 codes. This requirement is onerous and pointless. The new codes should be evaluated as a whole, and based on the safety, environmental and welfare aspects as well as any potential economic cost.

It is always a mistake to argue with mom. Like a heart tattoo with your prom date's name, the Utah legislature should use its better judgment and reject the pointless building code adoption legislation and allow the review and adoption of codes to proceed, benefitting both the environment and increasing the safety and welfare of Utahns.

There is a war on building codes across the United States, and Pennsylvania is ground zero.

There is a war on building codes across the United States, and Pennsylvania is ground zero. The Home and Garden Channel (HGTV) is the

The Home and Garden Channel (HGTV) is the

Shari focuses on energy, environmental and building code policy, representing international companies, non-profits and trade associations in their policy and communications campaigns

Shari focuses on energy, environmental and building code policy, representing international companies, non-profits and trade associations in their policy and communications campaigns